BACS market in North America

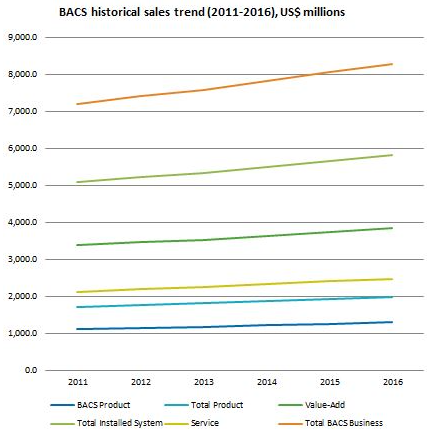

The BSRIA BACS North America – In-Depth Report reveals that sales of BACS products (Building Automation and Control Systems) was US$ 1,970 million in 2016, an increase of 2.5% on 2015, while total installed systems sales was US$ 5,801 million.

The total value of service and maintenance was US$ 2,475 million, pushing the total value of BACS business in 2016 to US$ 8,276 million.

Zoltan Karpathy, Manager – Intelligent Buildings and Homes, BSRIA, said: “The main factors driving market growth have been the uptake of data analytics and concern over energy costs.

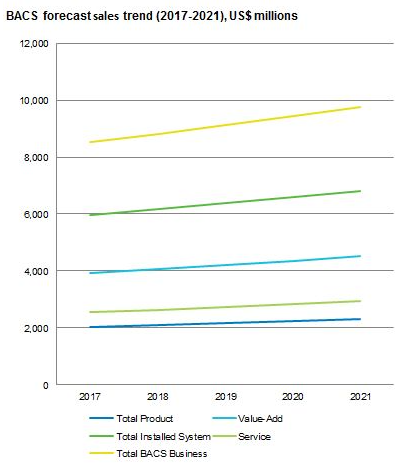

BACS forecast sales trend (2017-2021), US$ millions

The general performance trend of the BACS industry has been closely related to the USA’s and Canada’s economy and construction. As USA’s BACS market accounts for 86% of North America, the effect of the USA is much stronger than that of Canada. So, looking at the overall picture, Canada’s slowdown in the last two years is less visible.

USA rebounded strongly from 2010, where recession and annual growth of the economy has generally oscillated within the range of 2-3%.

Non-residential construction had a slight decrease in 2014 (-0.4%) but recovered strongly with growth rates within the range of 7-8% in 2015 and 2016.

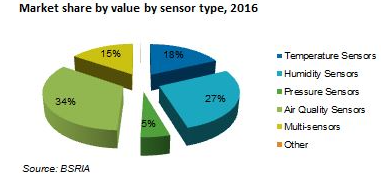

Market share by value by sensor type, 2016

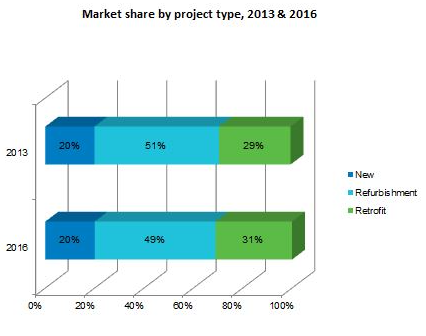

Overall, in the total market, the main drivers of growth are refurbishment and retrofit (not new construction) which benefit from a continued interest to invest in energy saving HVAC system upgrades. The US BACS market had cautious spending in 2016 due to the presidential election.

The value of DDC controllers was US$ 812 million, of which 63% are field level controllers; their share has been growing faster than the sometimes overcomplicated automation controllers.

Currently the controller market is dominated by the top five manufacturers, Honeywell, Johnson Controls, Siemens, Trane and Schneider Electric.

BACS historical sales trend (2011-2016), US$ millions

Zoltan said: “In terms of value, air-quality type (including CO2) is the most popular type of sensor in North America, accounting for 34% by value. This trend is due to the emphasis placed by companies on healthy living and increased productivity. Also it is policy driven as most states mandate legislation for air quality in schools and universities.”

A major trend is to add energy data analytics (Building energy management systems - BEMS) to existing BACS solutions, which continues to support retrofit/refurbishment sales, allowing BACS systems previously working in isolation to be integrated with other applications via open communication protocols.

Zoltan continued: “With the building automation segment continuing to grow in North America, there is an incentive for new players to enter the market in order to gain a share of this expanding business. This process is reinforced by the increasing trend towards integration of building automation and controls with other areas of smart technology, such as cloud-based monitoring management and smart homes. As one of the world’s largest markets for building automation, North America is a natural target for such activities.”

Market share by project type, 2013 & 2016

The purpose of the study was to provide a detailed quantitative and qualitative assessment of the current and future markets for intelligent control systems in non-residential buildings in North America.

For more information see BSRIA Market Intelligence.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

The Home Energy Model and its wrappers

From SAP to HEM, EPC for MEES and FHS assessment wrappers.

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.